Understanding consumer spending habits allows operators to drive sales and guide development. For most consumers, money to patronize restaurants comes from the discretionary spending category of their budget. Knowing whether consumers are feeling economically confident to spend on nonessentials or are watching every dollar closely allows restaurants to maximize consumer loyalty and their bottom lines.

Bubbakoo’s Burritos, a Mexican fusion QSR, was born as a sharp recession struck in 2008, so the brand’s leaders are keenly aware of the importance of monitoring the health of the consumer’s wallet. Bubbakoo’s executives track macroeconomic indicators, such as federal unemployment statistics and industry-specific measures, such as the average ticket value of different restaurant segments, to spot economic trends.

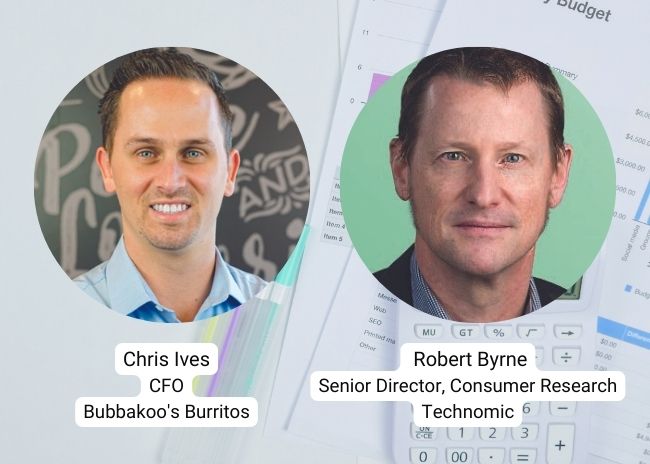

Some of its most valuable consumer data, however, is embedded in the brand’s POS and mobile order app systems. “We look at everything around frequency of transactions,” says Chris Ives, chief financial officer, Bubbakoo’s Burritos. The company’s loyalty program, which offers perks for frequent guests, tracks the number of repeat visits per month. That statistic is more important to the brand than average ticket price, Ives says. Customers that reduce their visits will spend a lot less than customers who maintain the same number of visits but choose lower-priced options, he reasons. Delivery service apps such as Door Dash and Uber Eats provide more data that show if consumers are cutting back on delivery orders or resisting price increases, Ives adds.

This leads to real-world results. For example, when customers are carefully scrutinizing spending, a fast-food establishment might offer a new menu with $10 value meals composed of a sandwich and a drink, omitting sides. “This way you’re playing with the menu so that you’re not eating away on margins per item,” says Robert Byrne, senior director, consumer research, Technomic. A restaurant that focuses on special events such as birthday and anniversary parties might “double down on the experience,” he says. “Food costs are what they are, but maybe you can elevate service.”

With such powerful cloud-based analytics and the ability to reach specific segments of the customer base via mobile technology, Bubbakoo’s uses data such as average monthly visits for targeted marketing. For example, it can text customers who have been reducing monthly visits with ads that highlight the brand’s “inflation-buster menu” — a document that shows pre-selected options with less costly ingredients (chicken instead of beef or shrimp, for instance.) This entices value-conscious customers to return to their customary number of monthly visits. Bubbakoo’s is a quality QSR, Ives says, so it won’t be offering $5 value meals, but showing frequent customers how to save several dollars per month without sacrificing quality or deeply discounting menu items makes for happier customers and a healthier bottom line.

But that’s not all. Tracking economic indicators helps with other business decisions including assessing whether a location is right for expansion, Byrne says. Some third-party software can take the latest consumer spending data from federal government sources and drill down to the level of individual zip codes. Brands can use this data to get a read on how potential customers are faring economically within a given radius of the intended location. +